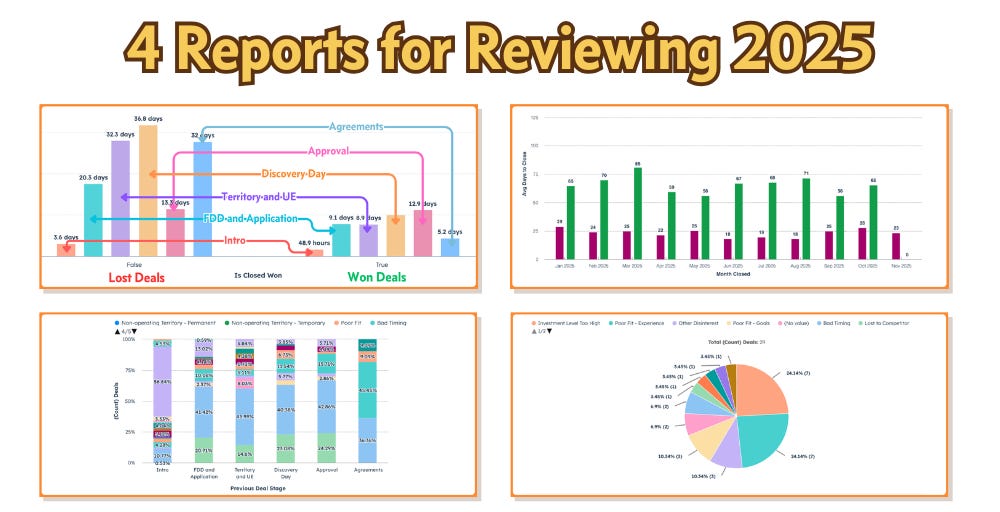

4 Reports for Reviewing 2025

You can't fix what you don't see. Day-to-day reporting doesn't give you the insights you need to improve your diligence process.

In this Lab Report:

We’re halfway through Q4. You’re focused on closing the year, it’s also time to think about 2026 and what to do differently. Here are 4 reports most Franchisors don’t have that will help start your analysis and thinking about what you can do to improve your 2026 results.

Why this matters

What do you want out of your 2026 Franchise pipel…